Background

Family Businesses are the engine room of the Australian economy. They employ over 50% of the Australian workforce and generate over 50% of GDP.

Family Business is not small business, although many Family Businesses are small. They also comprise approximately 100 of the 500 largest companies in Australia. Many are large corporations. However, and fundamentally: Family Business makes no sense – because the key success factors that make for a great business are diametrically opposed to the key success factors that sustain happy families.

Implications and Consequences?

Families and Businesses should never be put together, because that places both at risk however, if you’re daft or desperate enough to do it (like so many before and yet to come), then you’d better make sure that both the family and the business are actively working hard on neutralising their contradictions – turning potential weaknesses into towering strengths – to become great businesses, and happy families. This is where independent advisers, there for the long-term on Family and Business Boards, can make a real difference.

Family Business Challenges

Most Family Businesses face similar challenges, including:

- Do we have a family-first or business-first orientation? Is the business run according to sound business principles, or primarily to satisfy family needs? Check: does the business actually operate the way its leaders claim they want to operate?

- Do the family and the business have appropriate plans, sufficiently segregated to provide clarity for each entity? These comprise a long-term family plan and a medium-term strategic business plan.

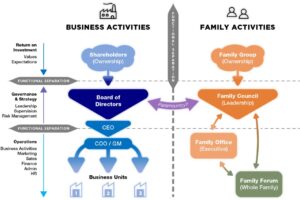

- (Assuming the family and the business have appropriate plans), do they also have appropriate structures in place carry out those plans? Family Business best practice recognises the need to have appropriate bodies in place in each entity to: (a) set goals and (b) manage their people and processes to achieve those goals.

- Business Families and Family Businesses should operate, to some degree, in similar ways. Both need appropriately disciplined systems in place (policies, procedures, and processes) so everybody knows “the plan”; what needs to be done; how things need to be done, who needs to be doing it, and when. They shouldn’t be in a state of constant confusion, reinventing their wheels.

- Even with strategies, structures, and systems in place, if the family and the business don’t have the right people in the right positions with the right skills, committed to doing the right things, in the right ways, at the right time, success will be hard to find. Of course, skills required to be effective in business are very different to the skills required to be a valued and contributing member of a family, although Business Families can require a high degree of crossover.

- Family Businesses (dynasties), aristocracies, and royalties have been studied for hundreds of years. Certain principles have been distilled, one of the most fundamental being the need to consciously separate family thinking from business thinking for planning and decision-making purposes.

- Family Businesses also need to be constantly aware, promote good communications, and be able to launch prompt responses to issues and potential problems. Problems fester within families when left unaddressed and can grow from mild irritant to catastrophic catalyst.

Ultimately, a happy family should support its business activities while its strong business supports the family. This only happens when both are paddling contentedly in their respective ponds, rather than each one attempting to cannibalise the other.

Family Business Best Practice Structures

Family Business best practice structures are reasonably well-known and understood. Structures are bodies established by organisations for the express purpose of having responsibility, authority, and accountability for planning, managing, and ensuing that things get done. Each Board should be tailored to the unique needs of a specific business, and family, within flexible frameworks.

Governance

Governance is the system of leadership and management that directs and operates an entity. Good governance requires appropriate structures to be established to define, monitor, and maintain high quality systems.

Individuals appointed to governance roles need integrity and objectivity, as well as relevant skills to discharge their responsibilities. This presents challenges for Family Businesses, where some individuals hold multiple roles that expose them to a range of emotional and relationship challenges, alongside obvious conflicts of interest.

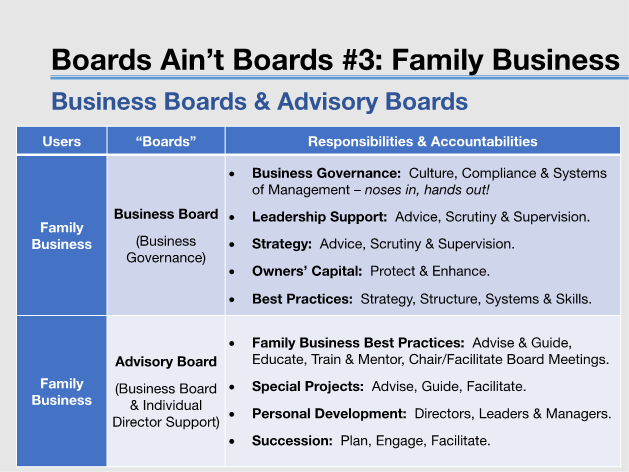

Business Boards

There is an enormous amount of confusion about the form, nature, and functions of “Boards”. A quick review of definitions and descriptions in Google reveals many contradictions that go against what actually happens in the real world.

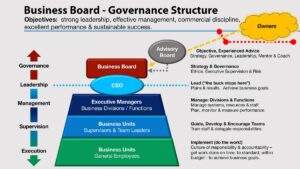

For our purposes, in relation to Family Business and Business Families, Boards are appropriately formal structures, established to direct, guide, monitor, and supervise the activities of the organisation. To do this effectively, the Board needs to be able to maintain a reasonable degree of independence and objectivity – which is hard to do when some or all of its members are also active within the family and/or within the business.

A typical Family Board, or (Family) Business Board should be non-executive in function (ie: members don’t work in the business simply because they’re Directors). If they work in the business day-to-day, they should operate through clearly defined leadership, management, or general employment roles. Job descriptions help to avoid confusion and facilitate supervision of such individuals by other board members – specifically charged with so doing.

The non-executive nature of the Board, and its directors, is captured in the phrase: “noses in, hands out”. Board members should be informed and engaged in the doings of the business, but should not interfere at an operational level, unless doing so forms part of their day-to-day responsibilities, or they’ve been invited in by a duly authorised executive.

A typical Family Business Board has four main duties:

- Strategy – ensures that business directions, plans, and results are congruent with shareholder requirements and that owners’ interests are protected. It’s the role of professional management, led by the CEO, to develop and implement Strategic Plans. It is not good practice for a Board to develop a plan in isolation and then impose it on the people responsible for carrying it out. The Board should rather provide constructive input, and then review, refine, and approve its executive’s strategy plans.

- Governance – ensures that appropriate systems of management are in place and functioning as required to meet the organisation’s legal compliance obligations and the dictates of (appropriate) business best practices.

- Executive Supervision – ensures that all senior executives (including family employees and board members), are adequately and appropriately discharging their responsibilities. This presents major challenges in a Family Business if an owner, or a protected family member, is performing at sub-optimal levels.

- Risk Management – Board members need to be able to get out of the weeds to identify larger threats to the business. To do this they need to be aware of, and connected to, the outside world, and be able to think laterally about business environments.

Under Corporations Law, the roles and functions of business boards and their members are defined by legislation that imposes clear responsibilities on directors. At a public company level these responsibilities are onerous and can be dangerous. Directors are remunerated accordingly for their time and effort, and for the risks they take on.

Most Family Businesses have very different requirements. They need their boards to be more practical and constructive, and less formally bureaucratic, although the above four responsibilities remain.

NEDs and Family Business Advisory Boards

Family Businesses generally operate “close to the ground” – where flexible advice and firm, adaptive oversight are more useful than insistence on strict regulatory compliance obligations.

This is why independent NEDS (non-family, non-executive directors) and Advisory Boards can play an important role in the growth and development of a private business – adding external experience, technical knowledge, and wisdom to the resources at the disposal of a family and its business.

NEDs are formally appointed as directors to business boards. Larger, sophisticated Family Businesses with well-established boards often appoint a couple of NEDs to provide the higher levels of independence, objectivity, and external experience needed to help them deal with the sort of complex business and family issues that typically challenge and embarrass family directors.

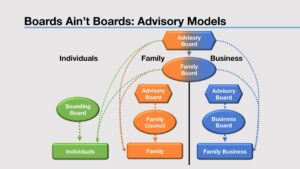

Enter the Advisory Board. It’s a Clayton’s Board that has no formal or legal standing, but may nevertheless exert enormous influence over both the family and the business if its members are competent, respected, and highly engaged.

Advisory Boards can advise Business Boards, Family Councils, Family Boards, and even individual family members. As the name suggests, they’re there to advise and guide, rather than make decisions.

They can undertake tasks and projects and have separate meetings, but they usually work more closely with formal boards – attending the same meetings, and contributing as additional board members up to the point of decision-making. The Advisory Board then becomes a ghost without substance.

Members can be appointed and dismissed with minimal formality. Engagement contracts (these are usually paid roles) are used to determine responsibilities, in accordance with Board / Advisory Board / Family Council charters.

Modern Advisory Boards are increasingly used to help engage and manage professional advisers on project-based, limited-time briefs – usually aimed at delivering business growth and professionalisation and/or the facilitation of succession plans.

The Advisory Board Chair leads, engages and directs an Advisory “Board” of professional advisers (from one to several people) using their own professional advisory experience to obtain maximum benefits to the business from the advisers they engage.

This represents a radical departure from the old paradigm of engaging a reputable firm to provide consulting services:

- Traditional model – clients rely on their connections with a firm’s principal to make initial contact. After committing to an engagement they have limited control over the personnel actually provided for the assignment. The contracted services may be provided on highly a transactional, fees for service, basis.

- Advisory Board approach – the Chair selects and appoints trusted individuals to provide professional advisory services, either as private specialist advisers, or through their firms. Appointment to the Advisory Board is personal to the selected individual who, from the induction process onwards, is encouraged to develop a deep understanding of the objectives of the business, and of the family behind the business. This tends to produce a more valuable, relationship-based service.

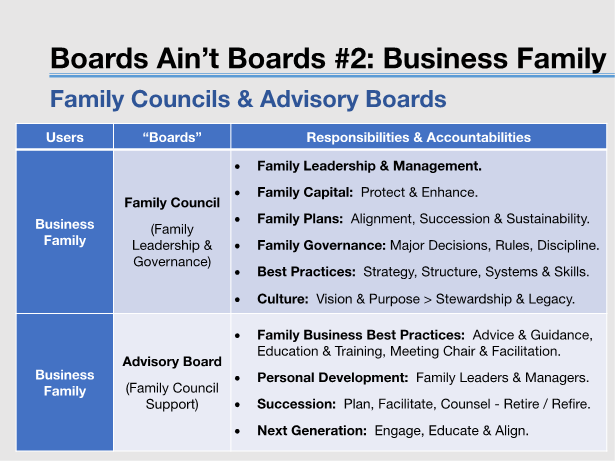

Business Family Advisory Boards

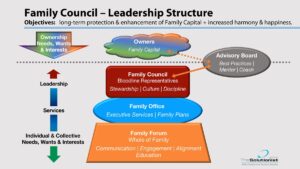

Most Business Families need to establish and empower a paramount decision-making body when they reach a size that encourages them to start building a legacy for future generations. This is the role of the Family Council – effectively a Business Board for the family, with a main focus on family issues, and on matters that impact the family.

Family Council members are selected to represent the main family bloodlines, as determined by the family, at some critical point in time. It’s a generational thing.

As with Advisory Board members, Council members’ appointments and roles are neither defined, nor subject to, any specific legislative legal requirements, other than those determined by the family itself. This enables the Council to be tailored to the specific needs of the family at a specific point in time.

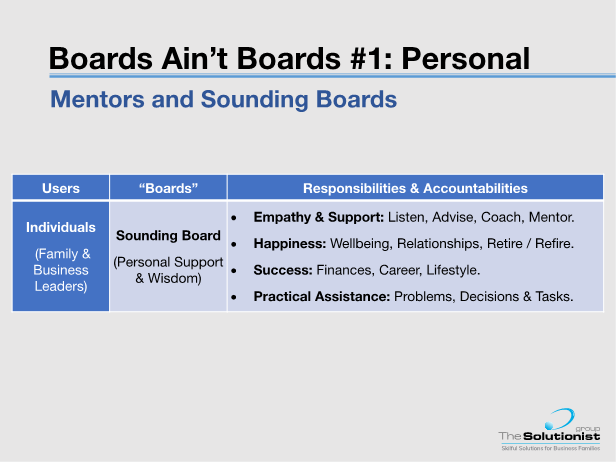

Sounding Boards

Entrepreneurial individuals may benefit from (and may only tolerate!) something far less formal than any of the Boards described above. It’s a personality, and an “ages and stages”, thing where they do far better with a trusted adviser capable of operating as a confidential mentor and coach for their private and business lives, than interfacing through a more formal board environment. Of course, they can have both.

Sounding Boards operate like “professional best friends”. Once they gain the trust of multiple family members, they can find themselves embedded like an Italian consiglieri in the intimate workings of the whole family.

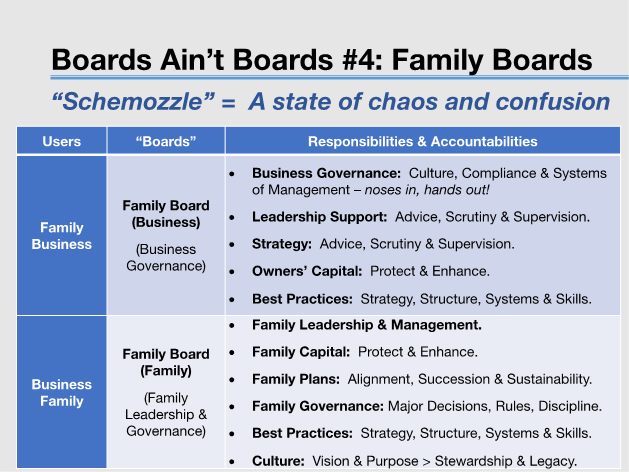

Family Boards

The Family Board concept is problematic. It clashes with a basic tenet of Family Business best practice: separate family-think from business-think and treat both entities as entirely separate to make it easier for them to be complementary, rather than competitive, or compromising.

Family Boards incorporate the roles and functions of Business Boards and Family Councils by using the same people to make decisions for the business and the family within a single forum. Unless their meetings are very effectively chaired, using strict protocols that maintain adequate separation and space between the separate interests and needs of the family and the business, there’s a high danger of developing a “schemozzle” – confusion, chaos, and competitive conflict – when agendas get hijacked and cannibalised, and family-think is allowed to influence, and perhaps overwhelm, business-think. This never produces good outcomes.

We strongly recommend establishing separate bodies: (a) Business Board and (b) Family Council – so even if you have the same people on both bodies (hopefully, with at least two non-family independents) – everybody knows what hat they’re supposed to be wearing at meetings, and he right headspace (family mode or business mode), especially when it comes to discussions, problem-solving, and decision-making.

Appointing Directors

The selection, appointment, and subsequent management of Directors, Family Council members, Advisory Board members, and Mentors / Sounding Board members are all critical to achieving a happy family and a strong business.

Good appointments add value and help to avoid a lot of angst and brain damage; poor appointments waste time, money, and opportunity – potentially causing financial damage to the business, relationship damage within the family, and personal damage to individuals.

Some Family Businesses are seduced by their ability to appoint retired directors from iconic listed companies to their Business Boards, because they’re available, or because someone is doing someone else a favour. In our experience this rarely works as expected because the majority of said directors, experienced and eminent though they be, don’t actually have much, or any relevant experience of private business operations, style, or culture. They also feel compelled to push the business towards aggressive growth and increased short-term profit, because that’s what they were expected to do in their listed company appointments.

Unfortunately, this conflicts with the long-term (patient capital) objectives of most Business Families, and puts enormous pressure on business leaders and managers, most of whom work in Family Business because they don’t want to work in a listed company environment, with all their short-term profit commercial pressures.

There’s more to life than increasing shareholder value!

Advisory Boards provide an excellent (mutual) probationary option. Family Businesses can place potential Business Board and/or Family Council appointees on their Advisory Board(s) to: (a) help them get a feel for the family and its business; (b) observe how they function from an empathic and collaborative perspective; and (c) see how they contribute to the fortunes and wellbeing of the family and/or the business.

We recommend doing this for at least 12 months before appointing anybody to any body.

We also suggest that anybody willing to accept appointment to the board of a private business, unless it’s a very well-known and well-established business, is probably someone you should be wary of appointing. That’s the whole point of courting – try before committing – they could be a bit desperate and dateless!