A Company Board is a legally constituted Board of Directors under the Corporations Act 2001. Its role may be anything from: (a) being there because, at law, you have to have one in a company (compliance requirement), to: (b) being there to support and supervise business operations (governance).

A Company Board is a legally constituted Board of Directors under the Corporations Act 2001. Its role may be anything from: (a) being there because, at law, you have to have one in a company (compliance requirement), to: (b) being there to support and supervise business operations (governance).

A Family Board is a term used to describe two or more family members who may, or may not be, formally appointed to a Company Board, as directors under the Corporations Law.

Whether or not family members (or others) are formally appointed, and notwithstanding whatever they call themselves, if individuals represent themselves to others as directors, they may be regarded at law as “deemed directors”, with all the potential liabilities that implies.

Role of the Family Board

Family Boards, when acting in “Board Mode”, help individuals to get into a headspace where they can work “on” the business, rather than “in” the business. This only seems to happen when there’s a recognised separation between business Strategy and business Operations, where “Strategy” is mainly thinking, and “Operations” is mainly doing.

Strategic Leadership

This is thought leadership rather than active, day to day leading – setting overall directions for the business, according to shareholder values and objectives, and always subject to business best practice.

Governance

Corporate governance refers to the structures, systems, policies and especially the processes by which businesses are led, managed, supervised, operated and measured – to achieve their strategic objectives. Governance styles and systems define and build the style, attitude, culture and integrity of an organisation.

Supervision

Board members should supervise and mentor senior operational executives / managers through formal and informal performance management systems and processes. Family businesses, like all businesses, benefit from responsible role separation hence, the Chair of the Board should not be supervising the CEO, if that role is filled by a son, daughter, or other close relative.

Risk Management

Business involves risk. It can’t be eliminated; it must be managed. If the Family Board is capable of detachment from operations (day to day risks) it will have a much better chance of spotting strategic risks (big picture, follow and join-the-dots risks), in time to actually do something about them. Both elements need to be properly executed to provide the business with effective risk management.

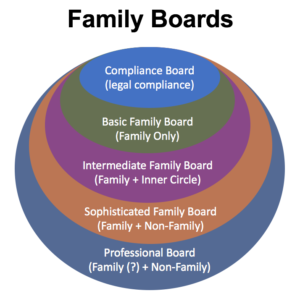

Classification of Family Boards (notional)

- Compliance Board (micro business)

Single director only. Required by Corporations law. The sole director is usually fully engaged in day-to-day business operations.

- Basic Family Board (small business <$5M turnover)

3+ family members. Most or all directors also have operational roles in the business.

- Intermediate Family Board (SME: $5M to $25M turnover)

Family members + senior employees and/or professional advisers (accountants / lawyers). Family influence remains dominant, but now showing increasing respect for input from non-family personnel.

- Sophisticated Family Board ($25M+ turnover)

Family members + non-family, non-executive directors. Requires family directors to be adequately skilled to contribute meaningfully, as board members, to business operations. Problems beginning to arise if they’re just there to protect family ownership interests.

- Professional Board ($50M+ turnover)

Family members are involved only if they can contribute meaningfully, as board members, to the success and sustainability of business operations. Otherwise the family is likely to get better results, as owners, by having a fully professional board that operates independently in the business and in close collaboration with the Family Council, which determines the family’s requirements of the business.