“Where should I go?” – Alice.

“That depends on where you want to end up.” – Cheshire Cat.

(Lewis Carroll)

Family Business Services – Overview

Family + Business… makes no sense!

Families and Businesses are naturally incompatible. Families thrive on nurture and emotion; businesses thrive on competition and logic. Putting them together in a Family Business (as families have done since forever) is …dangerous.

Getting things right, and keeping them right, takes wisdom, courage, hard work, and luck. No family business ever became, and managed to stay successful, on luck alone.

Family Business Best Practice places learnings from thousands of business families, at your disposal: what works, what doesn’t work, and how to fix stuff that’s broken.

It starts with Planning, if things are OK. If not, we’ll help to fix your problems so you can start planning, and move on.

Family and Family Business Plans

Plans identify where you’re going; when you’re going; how you’re going to get there; and what everybody’s role is on the journey. Not having agreed plans is probably the single most common cause of Family Business conflict.

Business Families need 2 very separate, and complementary, plans:

- Family Plans to focus on family needs. Long term horizons: 25 to 100 years.

- Business Plans to focus on commercial and operational needs. Shorter time horizons: 2 to 10 years for Strategy; 1 year for Operations.

Selecting an Adviser

Taking your Family and your Business on the Best Practice journey means sharing learnings and experiences that work for you. You can buy off the shelf processes, and try to make them work … but they won’t. Success with your most precious asset – your family – requires processes carefully tailored to needs and personalities.

The right advisers make the trip safer, shorter, and more fruitful.

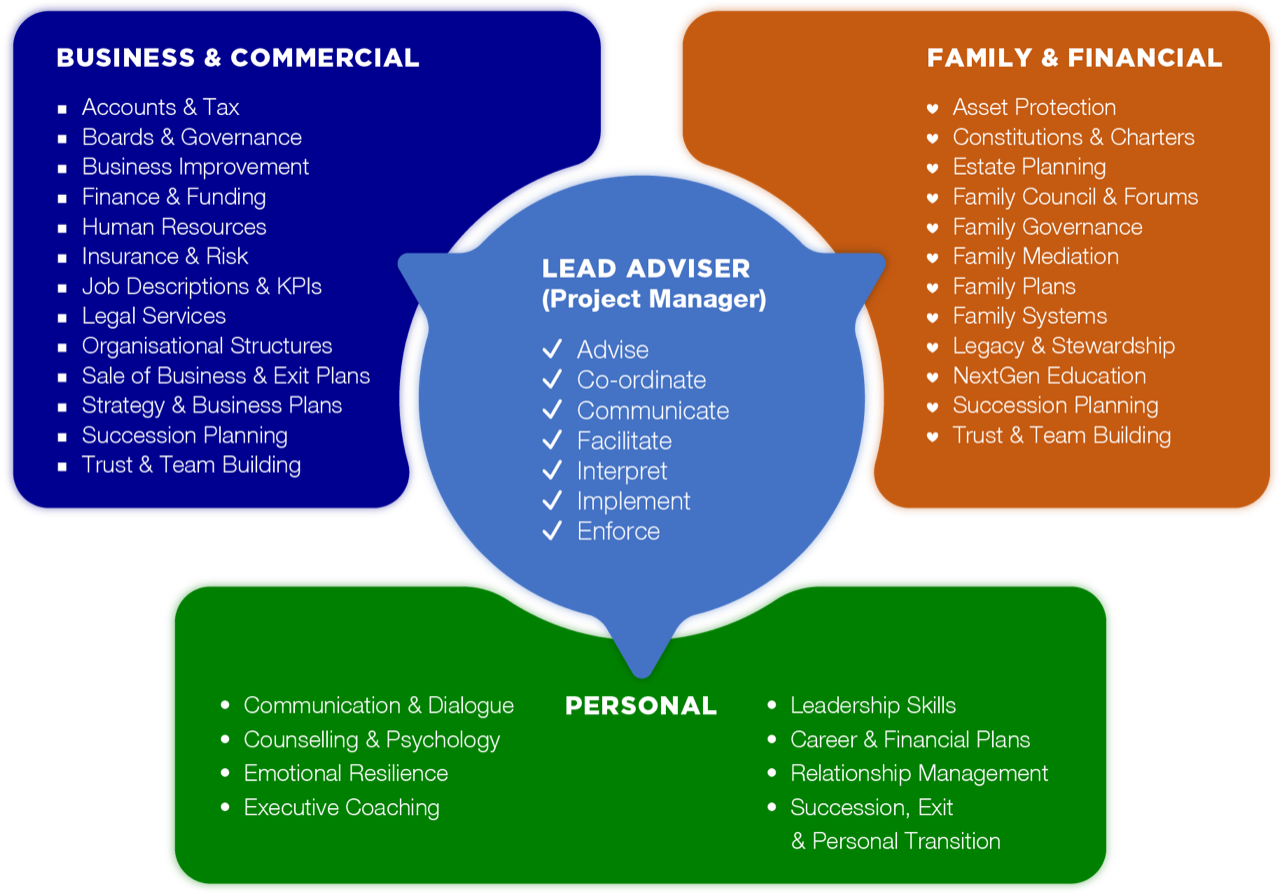

Family Business needs are complicated. They range from conventional commercial / financial / legal / business advisory, to intimate personal counselling and coaching. In between there’s strategic planning and problem solving, business improvement, conflict management, succession planning, and a host of other activities.

If you have clearly defined, conventional issues, it’s easy to find an adviser with appropriate skills and experience. If you’re unsure about your needs, have “complicated” human/family issues, require a more holistic approach, don’t know where to start, or don’t know who to turn to, please talk to an experienced family business adviser. They’ll scope and project manage the process for you, as a Lead Adviser.

Collaborative Advisory Approach

We promote a Collaborative Advisory Approach. The Lead Adviser helps the family to work out what they really need, and ensures they get the right advisers to supply the right services, the right way, at the right time, for the right price.

Co-ordinated efforts and expenditures produce better results and far better returns on investment. The family’s existing trusted advisers may also take on bigger roles than usual, as part of the advisory team.

We need to talk to someone about advisory services: